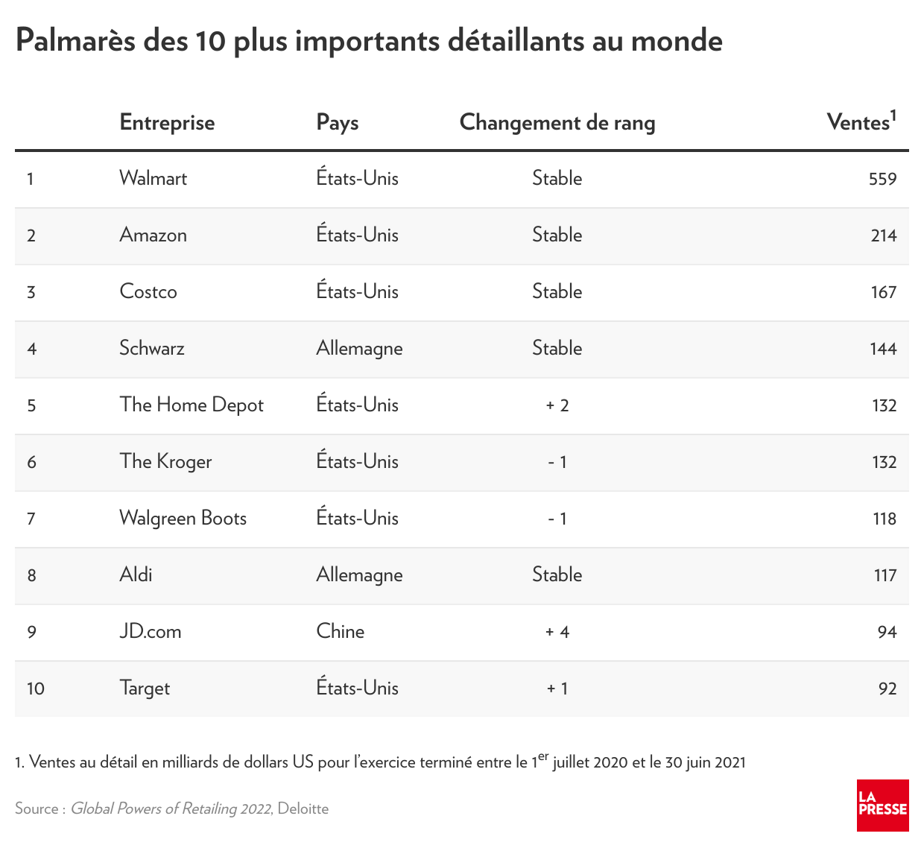

In the Retail Olympics, Walmart is always on top of the podium. Her pharaonic income gives her a comfortable head start over her opponents in the four corners of the world. But now a Chinese company with a meteoric rise is coming to the fore for the first time.

Posted yesterday at 6:30 am

Sixty years after its inception, the Walmart supermarket chain is still not badly old. Its concept continues to attract consumers to the point that nearly $2 billion enters its coffers every day. This is in fact, transactions!

Thanks to the pandemic and several innovations, the American giant saw its online sales rise by 79% in its most recent fiscal year.1.

If I tell you about the dominance of Sam Walton’s empire, it’s because accounting firm Deloitte revealed its traditional annual list of the world’s 250 largest retailers, according to sales. It is always interesting to examine this document with a magnifying glass and go back to see previous editions to discover the trends of the world’s consumers.

Last winter, I was struck by the amazing progress of Amazon, which just won two secondsAnd the rank, thus expelling Costco. Imagine, in 2011, Jeff Bezos ranked 35And the It ranks in the rankings with fewer sales than Canadian grocers Provigo and Maxi.

A Chinese Amazon called JD.com

Now another online retailer is going up the stairs in giant strides: JD.com. Unknown here, the Chinese company sells everything – makeup, clothes, delicatessen, furniture – and establishes partnerships with brands as diverse as Dior, Michael Kors and Walmart.

PHOTO MARK SCHIEFELBEIN, Associate Journalist

JD.com headquarters, Beijing

JD.com entered Deloitte’s list relatively recently, in 2014, under its previous name Beijing Jingdong Century Trade (142And the Rank). This year, it already occupies 9And the Rank.

What a sweet coincidence, Thursday, JD.com revealed the results of its post-workout workout that was used to establish the top 250. You guessed it, the jump is amazing. In local currency, sales grew 28% to the equivalent of C$190 billion (at today’s prices). This result may allow it to rise again next year.

Chinese companies are famous for supplying retailers around the world through their factories. But as the wealth of its workers increased, giant retail companies began to appear in China. It is progressing rapidly without even leaving the country thanks to its huge population. Furthermore, JD.com only sells in one country, as opposed to 26 for Walmart and 21 for Amazon.

So we haven’t finished hearing about fast-growing Chinese retailers. Of the 50 brands that have increased their sales the most, five have been established in China.

The United States leads this ranking with 11 companies. Canada has 2 (Lululemon and Save-On-Foods, a grocery in Western Canada).

home depot and climb target

You wouldn’t be surprised to learn that the Home Depot brand has tapped into the fervor of North Americans since the start of the home renovation pandemic. This allowed him to increase his turnover by 20% and take two places in the charts.

The target company posted the exact same result (+20%) and thus returned to Top 10. By comparison, sales at its largest competitor, Walmart, were up 6.7%. Just because Target had a fiasco in Canada doesn’t mean it doesn’t do well across the border…

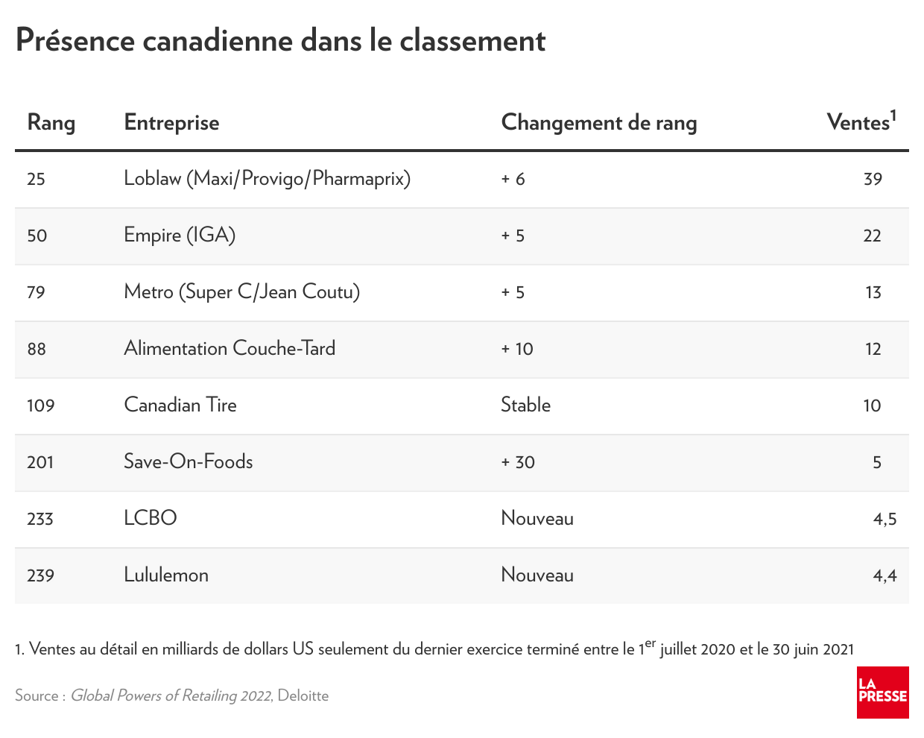

Two Canadian appetizers

A word now about the Canadian presence in top 250 worldwide. It rarely increased with the arrival of two new names simultaneously.

They are LCBO, the Ontario equivalent of SAQ, and Vancouver-based clothing retailer Lululemon, which has more than doubled its online sales in a challenging environment.

Deloitte also determined that out of 32 companies in the apparel sector, 23 reported low double-digit revenue. For US stores Macy’s, Nordstrom, and Dillard’s, it’s about 30%.

These entries bring the number of Canadian companies on the list to eight. Among these, two are from Quebec, Metro and Alimentation Couche-Tard, whose gasoline sales are not taken into account.

Interestingly, apart from Canadian Tire, which has been consistent, all Canadian companies have risen in the rankings, thanks in large part to the changing epidemic of consumer habits (intentionally or unintentionally). What will be the effects of the second year of imprisonment? The answer is in general.

1. Retail sales only, for the last full fiscal year ended between 1Verse July 2020 and June 30 2021

“Subtly charming problem solver. Extreme tv enthusiast. Web scholar. Evil beer expert. Music nerd. Food junkie.”