As the world of finance becomes increasingly digitized, maintaining a healthy credit score has become an essential aspect of personal financial management. Understanding and improving your credit score can be a game-changer when applying for loans, credit cards, or even some jobs.

One of the popular platforms that help you do so is Credit Karma. In this comprehensive review and guide, we’ll delve deep into Credit Karma’s services in Canada, offering insights into its operations, benefits, and how you can make the most out of it.

Understanding Credit Karma

Credit Karma is a free online service that allows users to check their credit scores, reports, and monitor their credit. The platform operates in several countries, including Canada, where it has emerged as a trusted tool for millions of Canadians aiming to understand and improve their creditworthiness.

How Does Credit Karma Work?

Credit Karma partners with two of Canada’s major credit bureaus, TransUnion and Equifax. The credit scores provided are based on these bureaus’ data and use the CreditVision Scoring model. This model considers various factors from your credit report such as payment history, credit usage, credit age, and recent inquiries.

To use Credit Karma in Canada, you need to create a free account on the Credit Karma website or mobile app. During sign-up, you will be asked for personal information like your name, address, and part of your Social Insurance Number (SIN). Once you’ve completed registration, you can access your credit scores and reports.

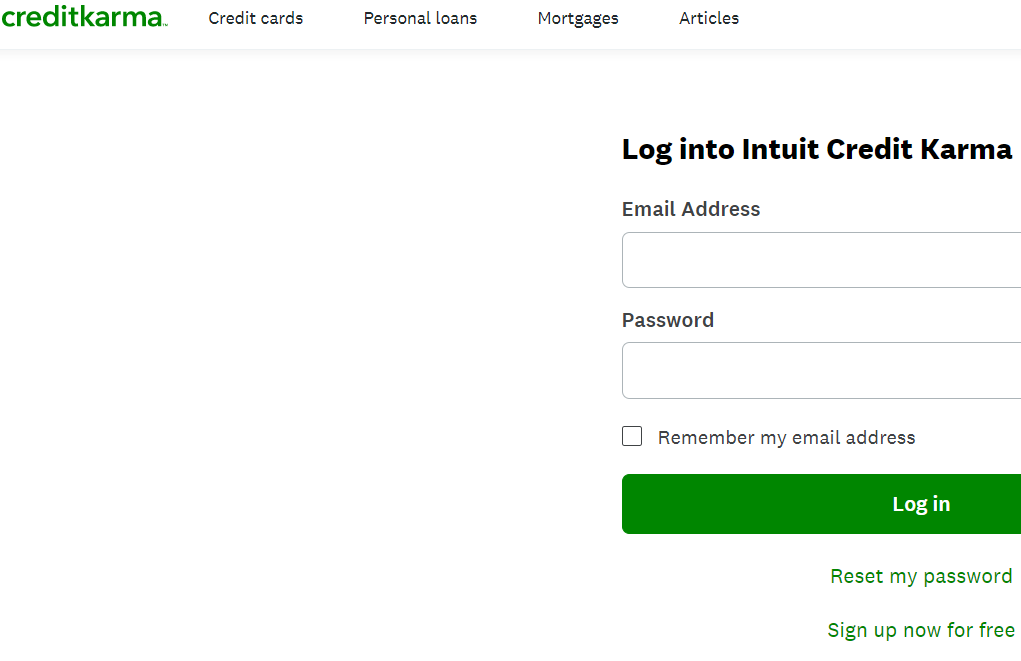

Credit Karma Canada Login

Open Your Web Browser

Start by opening your preferred web browser on your computer or smartphone. This can be Google Chrome, Safari, Mozilla Firefox, or any other browser you typically use.

Go to the Credit Karma Canada Website

Go to the Credit Karma website and hit Enter on your keyboard or click the Go button.

Find the Login Option

Enter Your Login Information

Click the Login button. You’ll be redirected to a new page where you can enter your login information. You should see two fields to fill out: one for your email address and one for your password.

First, enter the email address that you used to sign up for your Credit Karma account in the Email field.

Next, enter your password in the Password field. Make sure to type it in exactly as you set it up, as passwords are case-sensitive.

Click Login

Once you’ve filled in both fields with your login details, click the Login button. This should be located directly below the email and password fields.

Verification (if applicable)

Depending on your security settings, you might need to verify your identity. This could be through a two-factor authentication process, where a code is sent to your mobile device or email. Simply input the code when prompted.

Note: Remember, if you’re having trouble logging in, it may be because you’re entering the wrong email address or password. Click on the “Forgot password” link if you need to reset your password. If you continue to have issues, consider reaching out to Credit Karma’s customer support for further assistance.

Key Features of Credit Karma

- Credit Score and Report: Credit Karma provides users with their credit scores and detailed credit reports. The scores are updated weekly, and the reports include information about credit accounts, inquiries, public records, and collections.

- Credit Monitoring: This feature sends you notifications when there are significant changes to your credit report, helping you stay on top of your credit status and spot potential signs of identity theft early.

- Credit Score Simulator: The simulator allows you to see how different actions, such as paying off debt or opening a new credit account, might impact your credit score.

- Financial Product Recommendations: Based on your credit profile, Credit Karma suggests financial products that may be a good fit for you, such as credit cards, loans, and more.

The Benefits of Credit Karma

- Free to Use: There are no hidden fees or charges. You can check your credit scores and reports, use credit monitoring, and access the score simulator entirely for free.

- Security: Credit Karma uses advanced security measures to protect user data. This includes 128-bit encryption and a dedicated security team.

- Easy Accessibility: With both a website and a mobile app, you can check your credit scores and reports anytime, anywhere.

- Educational Resources: Credit Karma provides a wealth of financial education resources and articles to help you understand credit scores and personal finance.

How to Maximize Your Experience with Credit Karma

- Regularly Check Your Credit Score and Report: Regularly reviewing these can help you understand how your financial behavior affects your credit score and identify areas for improvement.

- Use the Credit Score Simulator: This tool can help you make informed decisions about managing your credit and debt.

- Leverage the Financial Product Recommendations: While these are not a guarantee of approval, they can help you explore financial products that might be a good fit based on your credit profile.

- Take Advantage of the Educational Resources: Credit Karma offers an array of educational articles and resources that can help you enhance your understanding of credit scores, credit reports, and overall financial management. These resources can be invaluable in guiding you to improve your credit health and make informed financial decisions.

FAQ

Is Credit Karma available in Canada?

Yes, Credit Karma is available in Canada. It allows Canadians to check their credit scores and credit reports for free. Credit Karma Canada was launched in 2016 and has been serving Canadian customers since then.

How do I download my Credit Karma report in Canada?

To download your credit report from Credit Karma in Canada, first log into your account. On your account dashboard, you can view your credit scores from TransUnion and Equifax. To download your report, navigate to the Credit Reports section and select View Report.

From there, you can download and print your report. Please note that the availability of certain features can vary, and it’s always a good idea to check Credit Karma’s website for the most accurate and up-to-date information.

How accurate is Credit Karma in Canada?

Credit Karma provides a reliable estimate of your credit score. However, the scores you see on Credit Karma are based on the information available at the credit bureaus, so they might not be exactly the same as the scores a lender might use when considering you for credit.

This is because different lenders may use different credit scoring models or might look at different information when assessing your creditworthiness. Therefore, while Credit Karma can give you a good idea of your credit standing, it should not be used as a definitive measure of your credit score.

Conclusion

In a world where credit scores are increasingly vital, having a tool like Credit Karma is a significant advantage. The platform empowers its users by providing free access to their credit information and offering resources to help them understand and manage their financial health better. For Canadians, Credit Karma provides an easy-to-use, secure, and valuable service to stay on top of their credit situation.

Whether you’re working towards a financial goal such as buying a home or car, or simply wanting to understand where you stand with your credit, Credit Karma is a robust tool that can assist in your journey. By regularly checking your credit score and report, taking advantage of the credit score simulator, and leveraging the platform’s educational resources, you can be proactive in managing and improving your credit health.

In a nutshell, Credit Karma is a comprehensive platform designed to demystify credit scores and reports for Canadians. It’s an excellent tool for those who want to take control of their financial future by understanding and improving their creditworthiness. So if you’re ready to take a step towards better financial health, consider signing up for Credit Karma and let the journey begin.

“Proud thinker. Tv fanatic. Communicator. Evil student. Food junkie. Passionate coffee geek. Award-winning alcohol advocate.”