The Apple Credit Card, known as Apple Card, offers a unique and user-friendly credit option for Apple enthusiasts. It integrates seamlessly with Apple Pay and the Wallet app on your iPhone. While it was initially available only to U.S. customers, the card has been anticipated by Apple users around the world. As of the time of writing, however, the Apple Card is still not officially available in Canada.

This article will provide insights into what to expect when it eventually becomes accessible to Canadian customers and how to prepare for its arrival.

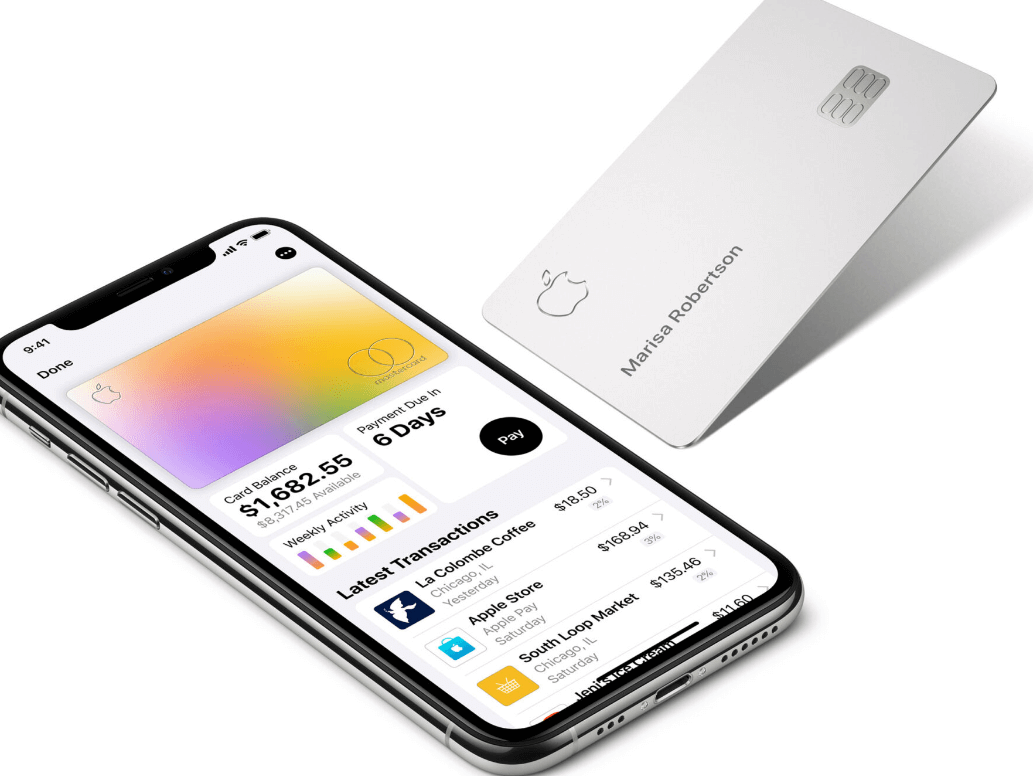

Apple Credit Card

Apple Card is a credit card service offered by Apple Inc., issued by Goldman Sachs. Designed to work with the Wallet app on your iPhone, the Apple Card provides a variety of features, including detailed transaction history, easy interest calculations, and a reward system called Daily Cash.

Key Features of the Apple Credit Card

The Apple Card offers several unique features that set it apart from traditional credit cards:

- Integration with Apple Pay: The Apple Card is designed to be used with Apple Pay, a mobile payment service available on iPhone, iPad, and Apple Watch.

- Daily Cash: Apple Card users receive cash back on their purchases every day. This cashback is credited to the user’s Apple Cash card each day and can be used for further purchases, sent to friends via iMessage, or transferred to the user’s bank account.

- No Fees: Apple Card does not charge any fees. This means no annual fees, late payment fees, or international transaction fees.

- Privacy and Security: Apple provides a unique security architecture known as Apple Card Privacy Architecture. It ensures that Apple doesn’t know where a customer shopped, what they bought, or how much they paid.

- Financial Health Tools: The Apple Card offers a suite of tools aimed at helping users understand their spending and make smarter financial decisions.

Anticipated Process for Applying for an Apple Card in Canada

While the exact process for Canadian users is yet to be announced, here’s an idea of how the process works in the U.S, which may be similar once the Apple Card is available in Canada:

- Update Your iPhone: The application process for the Apple Card is done through the Wallet app on your iPhone, so you’ll need to ensure your iPhone is updated with the latest iOS version.

- Open the Wallet App: Open the Wallet app on your iPhone and tap the “+” icon in the top right corner.

- Follow the Prompts: Follow the on-screen prompts to continue with your Apple Card application. You’ll need to enter personal information like your name, date of birth, email address, phone number, home address, and social security number (or equivalent for Canada, like the Social Insurance Number).

- Accept the Offer: If approved, you’ll be shown an offer that includes your credit limit, interest rate, and terms and conditions. If you agree to these terms, accept the offer, and your Apple Card will be added to your Wallet app immediately.

Prepare for the Apple Card

While waiting for the official launch of the Apple Card in Canada, you can prepare by doing the following:

- Get an iPhone: You need an iPhone that can support the latest iOS version to apply for and use the Apple Card.

- Set Up Apple Pay: Since the Apple Card is designed to be used with Apple Pay, ensure you have set up Apple Pay on your device.

- Check Your Credit Score: It’s important to maintain a good credit score as it will likely be a critical factor in determining your eligibility for the Apple Card, your credit limit, and your interest rate.

Prospective Benefits and Drawbacks for Canadians

Benefits

- Seamless Integration: The Apple Card’s seamless integration with Apple Pay and the Wallet app on your iPhone offers a convenient, user-friendly banking experience.

- Daily Cash: With the Apple Card, cashback is given on a daily basis, not monthly like many other credit cards. This means quicker access to rewards.

- No Fees: The Apple Card boasts no annual fees, late payment fees, or international transaction fees, making it a potentially attractive option for those seeking a fee-free card.

Drawbacks

- Limited to Apple Ecosystem: One potential drawback is that the card is largely limited to the Apple ecosystem. You will need an iPhone to apply for and manage the card, which may not appeal to non-Apple users.

- No Traditional Credit Card Benefits: Unlike some other credit cards, the Apple Card does not offer benefits like travel points, extended warranty, or insurance.

Frequently Asked Questions

Can I get an Apple Card as a Canadian?

The Apple Card was available exclusively to customers in the United States. It is not currently available to residents of Canada or other countries outside of the U.S. Anyway, It’s always a good idea to check the Apple Card official website for the most recent information about its availability.

How do I get an Apple credit card?

If you’re eligible to apply for the Apple Card, which is only available in the U.S. as of my last update, you can apply through the Wallet app on your iPhone. Here are the steps:

- Open the Wallet app on your iPhone.

- Tap the ‘+’ sign in the top right corner.

- Select ‘Apple Card.’

- Fill in the necessary information and follow the prompts to apply.

Remember, approval is subject to credit evaluation.

Will Apple Card come to all countries?

The Apple Card was not available in any countries outside the United States. Apple has not officially announced any plans to expand the Apple Card service to other countries. For the latest updates, it’s best to check the Apple Card official website.

Is it easy to get an Apple credit card?

The ease of getting an Apple Card largely depends on your credit score and financial history, as these factors will be evaluated during the application process. Generally, a good credit score improves your chances of being approved.

However, each application is evaluated individually, considering multiple factors. It’s important to remember that even if you can apply for an Apple Card, it’s vital to consider your personal financial situation and research all terms and conditions before applying for any new credit card.

Conclusion

The arrival of the Apple Card in Canada is an anticipated event for many Apple and tech enthusiasts. Its unique features—like seamless integration with Apple Pay, Daily Cash, no fees, and privacy and security protections—make it an attractive credit option.

However, its requirement for an iPhone and lack of traditional credit card benefits may limit its appeal for some potential users. It’s important for consumers to consider these factors and their personal financial needs and habits when evaluating new financial products like the Apple Card.

Remember, as of the time of writing, the Apple Card is not yet available in Canada, so potential users should stay tuned for the latest updates from Apple. Once the card is launched in Canada, it’s recommended that interested individuals review the specific terms and conditions of the Canadian Apple Card.

“Proud thinker. Tv fanatic. Communicator. Evil student. Food junkie. Passionate coffee geek. Award-winning alcohol advocate.”