What explains this phenomenon? Where does the cash end up at the end of its life? Will we ever come to Canada that no longer uses its actual currency? The Central Bank has provided us with the answers to all these questions.

1. Since Canadians use cash less, are more banknotes taken out of circulation than before?

According to the latest survey of the Central Bank, the value of banknotes in circulation increased significantly during the epidemic, especially in the first months. The value grew from $83 billion in March 2020 to more than $100 billion by the end of the year.

The large denominations – the $50 and $100 denominations – contributed the most to this increase. According to researchers at the Bank of Canada, the increase could in particular be due to the use of these notes as a store of value.

However, the demand for banknotes of small denominations has fallen, as cash-settled transactions have declined during the health crisis.

2. What guides the Bank of Canada’s decisions to withdraw or add banknotes from circulation?

Financial institutions place orders for banknotes from the Central Bank at the request of their clients. Then it is up to the Bank of Canada to fulfill these requests.

Financial institutions also send out their excess banknotes and denominations that are too worn, soiled, or damaged to be recirculated.

The central bank checks the condition of these banknotes using ultra-fast processing machines, and then destroys those deemed unfit for circulation.

3. Concretely, how are tickets withdrawn from circulation? Did the money burn? shredded? Stored?

Once polymer banknotes are deemed unfit for circulation—whether they are soiled, torn, deformed, or worn—the Bank of Canada shreds them and then sends them to a company that specializes in designing and manufacturing products made from fully recycled plastic.

This company mixes shredded banknotes with other plastic waste to produce a material and give it a second life.

Old cotton paper notes are automatically identified as out of circulation and shredded by the central bank. Once shredded, the banknotes are sent to a secure landfill site.

4. Canadians are increasingly embracing contactless payment methods. Have you ever thought about eliminating criticism altogether?

Four out of five Canadians say they have no plans to stop using cash in the next five years, according to a November 2020 survey by the Bank of Canada.

The proportion of cash-settled transactions between November 2017 and November 2020, both in volume and value, declined in favor of contactless payment methods. However, the cash was used on 40% of purchases under $15.

Older, less educated, and lower-income people use cash more than the rest of Canadians, according to the survey. The Bank of Canada will continue to offer banknotes and coins until further notice, as they are still used to settle one in five retail transactions across the country.

5. Can old tickets still be refunded?

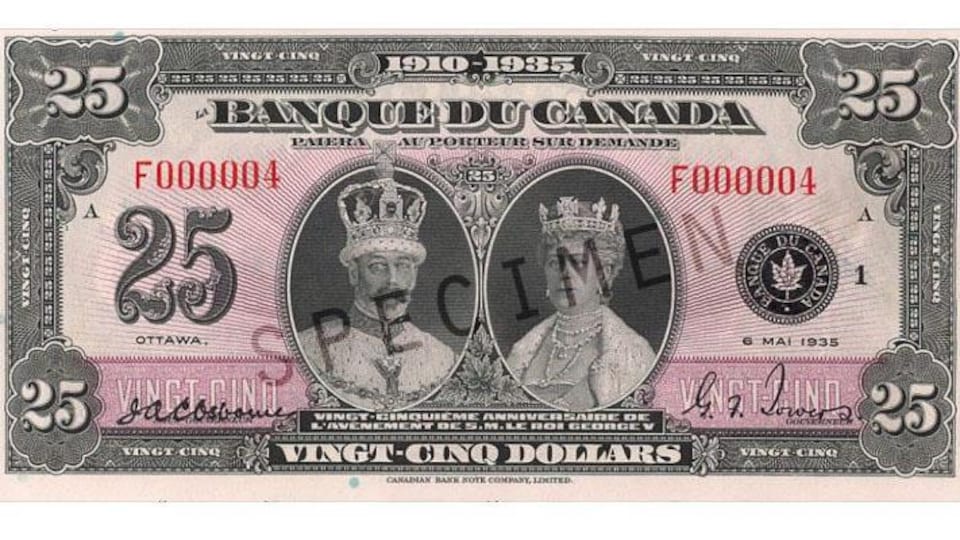

Even if they are no longer legal tender, Canadian $1, $2, $25, $500 and $1,000 banknotes retain their face value. You can take them to your financial institution or send them to the Bank of Canada for payment.

But beware: some rare banknotes—such as the $25 and $500 bills—may be more valuable to collectors than the number on them.

“Alcohol scholar. Twitter lover. Zombieaholic. Hipster-friendly coffee fanatic.”