Inflation, $90, skyrocketing home prices, rising interest rates, and exorbitant grocery bills are concerns across the country. But not much less in Quebec.

Posted at 6:30 a.m.

Quebecers stand out by displaying the highest level of flair in the country when it comes to their personal finances and the rising cost of living.

In the county, 58% of residents said they are concerned about their financial situation. Elsewhere in the country, the average is more than 66%, as we learned from a survey by Léger for Option consommateurs unveiled Tuesday. The highest percentage of anxious people (70%) is found in the prairie.

As for inflation, which is thrown on everyone’s lips, 35% of Quebecers believe that it causes significant stress in their lives. Again, this is lower than the average of 42% in other provinces. In the prairies, rising prices significantly stress half the population. Phew!

Those differences are “significant,” said Judge Christian Burke, executive vice president and partner at Léger. But it is not very surprising. Quebecers have always displayed “a little form of indifference and arrogance,” he said. Attitude is part of the distinguished community personality. And not just in finance.

At the height of the pandemic, Quebecers were less afraid than other Canadians of contracting COVID-19 and were more in favor of reopening schools, say the expert.

In surveys about satisfaction with businesses, Quebecers are “always more positive,” notes Christian Burke, who sees this as a “cultural bias.”

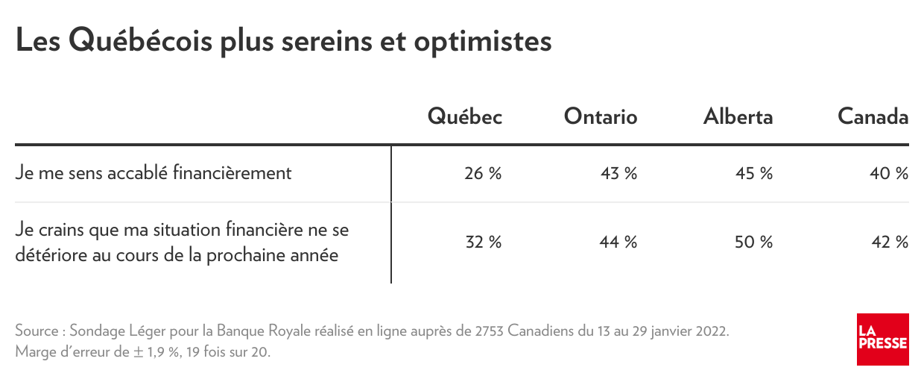

These differences were also reflected in the results of a survey conducted by Royal Bank in January. Canadians were asked if they feel “financial exhaustion” and if they fear their financial situation will deteriorate in the coming year. The differences between Quebec and the other provinces were staggering.

These results can be attributed to the special character of Quebecers, but we must not forget that the province’s economic growth fosters collective optimism. The unemployment rate hit a historic low of 4.1%, and wages in March jumped 5.5% in 12 months, Statistics Canada told us a few days ago.

I thought that the Legault government’s announcement of a $500 check to 94% of the population could have an impact on the survey results, but no, it was implemented in the previous weeks.

The situation, which varies from province to province, is also reflected in trustee offices in bankruptcy, notes Ronald Gagnon, partner at BDO Canada. “My colleagues in Alberta are totally overwhelmed! And those in British Columbia too. The context is different in Quebec, there are fewer insolvencies than there was a year ago.”

Uneven distribution of anxiety

In this type of study, it is always interesting to focus on the numbers that led to the mean and their dissection. Because this average hides many disparities, one would imagine.

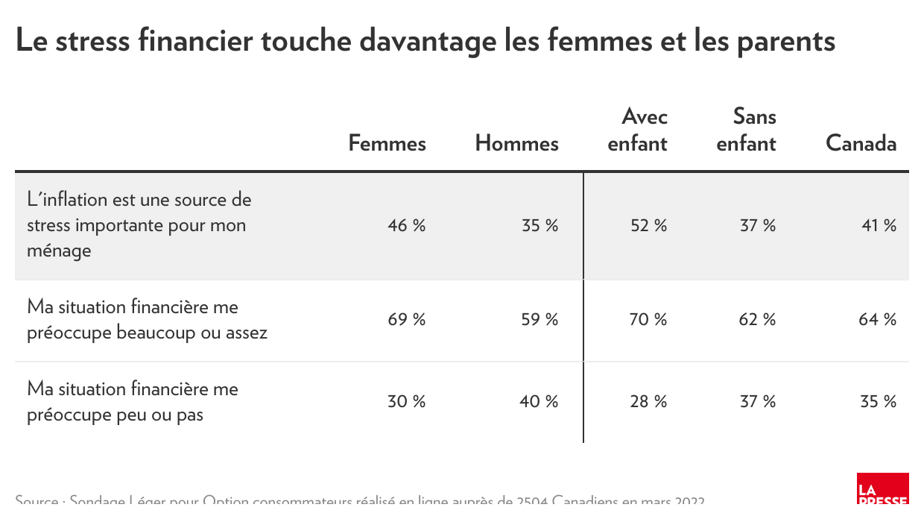

Women, for example, weigh less than men. Gaps 10 points or more.

This unfortunately exposed a number of facts, starting with the fact that women earn less than men. In addition, more of them have to provide for the needs of their offspring.

Having children also has a noticeable effect on one’s state of mind and wallet in the context of rising prices.

If inflation affects the less affluent much more, almost no one seems immune to concerns about their bank accounts. In fact, at least half of Canadians who earn $100,000 or more per year say they are concerned about their financial situation. The level rises to 77% among those whose income does not reach $40 thousand.

Options Advisors, which provides free budget advisory services in Montreal, notes that its clients are particularly concerned about the cost of food (+7.4% in February). “We see it when we post on social networks that explain, for example, how to make a grocery basket: people are looking for solutions,” said spokeswoman Marie-Yves Dumont.

It’s already the budget item that worries Quebecers the most, according to Sper Léger, just before gasoline. Rent, electricity, health, and telecommunications follow, in much the same order across the country.

As for personal debt (without the mortgage or car loan), it is the least of the worries in a privileged society, by a large margin. Are you surprised?

calling everyone

Does your financial situation worry you more than it did before the pandemic? Tell us why. Your answer can be posted.

“Subtly charming problem solver. Extreme tv enthusiast. Web scholar. Evil beer expert. Music nerd. Food junkie.”