After a year in the red, RDS became profitable again, although the sports channel Bell Media lost 11% of its subscribers in one year.

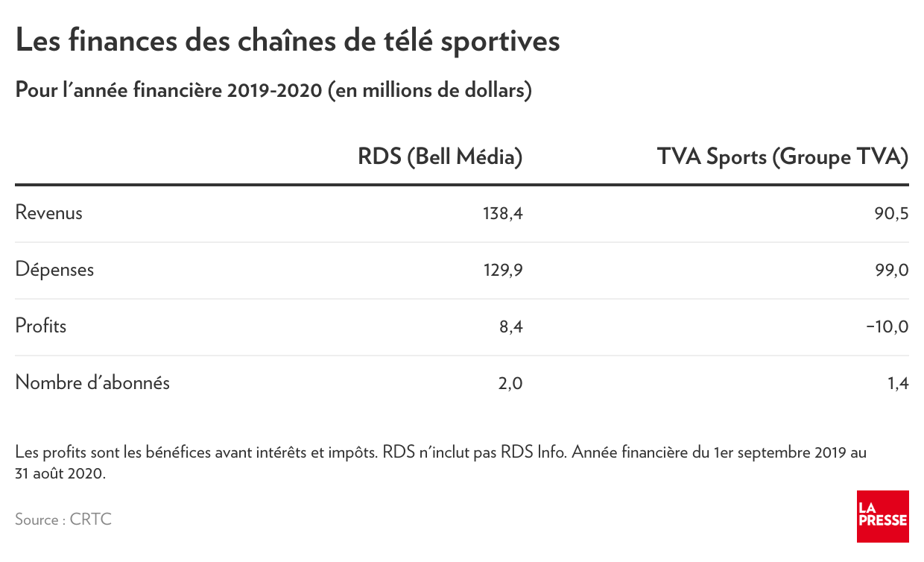

RDS rebounded in 2019-2020, posting $8.4 million in earnings before interest and taxes on revenue of $138 million, according to figures from the Canadian Radio, Television and Communications Commission (CRTC). The year before, the sports channel Bell Media – long the most profitable on the French-speaking small screen – had experienced first-year deficits (losses of $161,000) for decades. In 2015-2016 and 2016-2017, RDS generated profits of $26 million annually.

By including RDS Info – whose financial results are published separately because they are two separate licenses – Bell Media’s French-speaking sports channels generated $2.2 million in revenue in 2019-2020. RDS Info lost 6.2 million in the broadcast year ending August 31, 2020.

For its part, TVA Sports, which has not made a profit since its inception in 2011, continues to reduce its annual losses, which fell from 17 million in 2018-2019 to 9.97 million in 2019-2020.

This is the second year in a row that TVA Sports has cut its losses. From 2011-2012 to 2019-2020, the channel lost 202 million in 9 years, or 22 million annually on average.

RDS and TVA Sports are losing subscribers

RDS and TVA Sports have the same problem: they are losing subscribers. Lots of subscribers. In 2019-2020, RDS lost 11.4% of its subscribers (- 264,000 subscribers) while TVA Sports lost 7.2% of its subscribers (- 111,000 subscribers). In four years, RDS lost a third of its subscribers (32%) (3 million to 2 million), TVA Sports, a quarter of its subscribers (24%) (from 1.9 million to 1.4 million).

Subscription revenue generally represents 70% to 80% of revenue for specialized sports channels. The rest of the income comes from advertising. Sports channels generally pay the same amount they negotiated for the TV rights, regardless of their subscriber count. The fewer subscribers, the more difficult it is for these channels to monetize television rights contracts.

In addition, the most expensive television contracts were negotiated in Quebec – with the National Hockey League for TVA Sports and with Montreal Canadiens for RDS – before this drop in subscribers. RDS pays about $60 million a year to a Canadian, TVA Sports, about $60 million a year to the NHL.

Bell Media, owner of RDS, declined to comment. TVA Group has not responded to the email from Journalism.

Warning: the beginning of a pandemic

However, caution should be exercised when interpreting the results of RDS and TVA Sports in 2019-2020. In March 2020, the COVID-19 pandemic forced the suspension of the activities of professional sports leagues. As seasons lapsed, broadcasters often paid discounted television rights. In 2019-2020, total expenses such as programming and production expenses decreased by 13% in RDS and by 11% in TVA Sports.

Generally, sports channels broadcast their events at a loss and make their profit from subscription revenue. In the short term, it is possible that the epidemic will have a slight beneficial effect on their finances (if there are no disruptions), but it is impossible to say for sure.

In Canadian English, the sports channel TSN (Bell Media) and the three sports channels of Rogers Sportsnet generated revenue of 142 million (+30% in one year) and 98 million (-40% in one year) in 2019-2020.

Super Akran suffers from a deficit

The sign of the era, the on-demand channel Super Ecran – for a long time one of the most profitable channels – is now in short supply. In 2019-2020, it lost about $298,000, compared to a profit of $6.7 million in the previous year. Super Ecran lost 20% of its subscribers in one year. Super Ecran programming is also available on the online entertainment service Crave, which is not counted in the CRTC data.

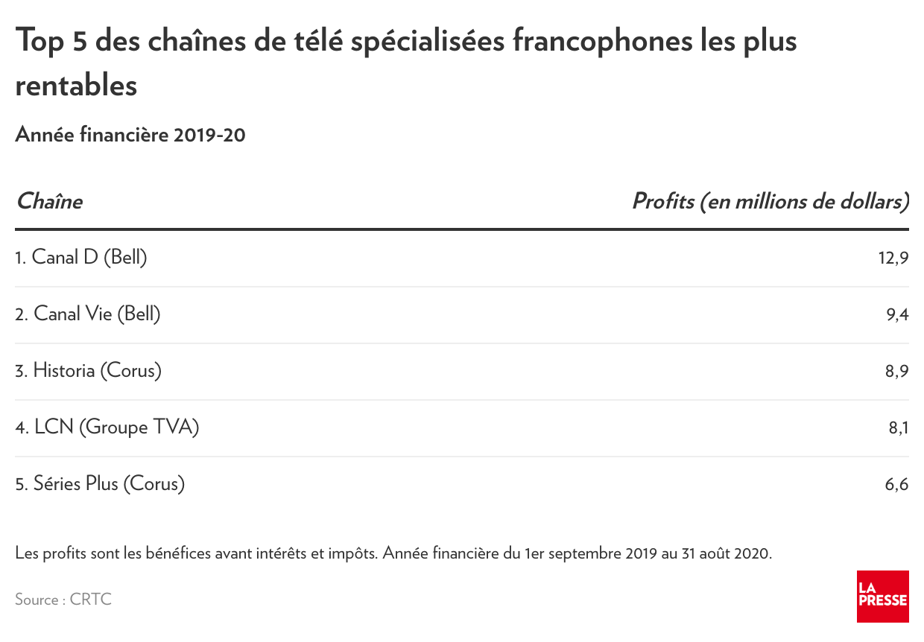

In total, 33 French-language specialized television channels generated combined profits of 70.6 million and revenue of 667 million in 2019-2020, an increase in profits of 2.6 million in one year.

Profits rose even though revenue fell 5.5%. why ? Because the chains cut their spending by 6.5%. Their profit margin was 10.6%.

For the third year in a row, Canal D is the most profitable French language specialized television channel.

“Pop culture maven. Unapologetic student. Avid introvert. Gamer. Problem solver. Tv fanatic.”